- Q2 Revenue up 400% versus prior year on increased customer demand for Advent product offerings and acquisition of UltraCell

- Net loss of $(3.14) million and adjusted net loss of $(6.79) million excluding warrant valuation adjustment

- Company holds cash reserves of $116.11 million

- Strong market interest reflected in high level of commercial activity

BOSTON–(BUSINESS WIRE)– Advent Technologies Holdings, Inc. (NASDAQ: ADN) (“Advent” or the “Company”), an innovation-driven leader in the fuel cell and hydrogen technology space, today announced consolidated financial results for the three months ended June 30, 2021. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with U.S. generally accepted accounting principles (GAAP).

Q2 2021 Financial Highlights

(all comparisons are to Q2 2020 unless otherwise noted)

- Total revenue of $1.00 million, a 400% year-over-year increase, the result of increased customer demand for Advent’s products across the board and the acquisition of UltraCell.

- Gross Profit of $0.33 million, a year-over-year increase of $0.35 million primarily due to higher revenues.

- Operating expenses were $7.2 million, primarily related to increased staffing and costs to operate as a public company, as well as our cooperative research and development agreement (“CRADA”) with the Department of Energy which we announced in March 2021.

- Net loss and adjusted net loss were $(3.14) million and $(6.79) million, respectively. Adjusted net loss excludes the impact from the change in the fair value of outstanding warrants.

- Net loss per share was $(0.07).

- Cash reserves were $116.11 million on June 30, 2021, a decrease of $8.87 million from March 31, 2021, driven primarily by the use of cash for operating and capital expenses and a $2 million payment to complete the acquisition of UltraCell.

“As a public company, we continue to see strong demand for our products from existing and new customers, especially following the acquisition of UltraCell LLC,” said Dr. Vasilis Gregoriou, Chairman and CEO of Advent Technologies. “The strong revenue growth in the quarter continues to demonstrate market interest in high-temperature proton exchange membrane (HT-PEM) based products. We are confident that many of our customers are on a fast growth trajectory and our HT-PEM based products are an enabling technology that will serve their needs.”

Q2 2021 Financial Summary

| (in Millions of US dollars, except per share data) | Three Months Ended June 30, | ||

|---|---|---|---|

| 2021 | 2020 | $ Change | |

| Revenue, net | $ 1.00 | $ 0.20 | $ 0.80 |

| Gross Profit | $ 0.33 | $ (0.02) | $ 0.35 |

| Gross Margin (%) | 33% | (9)% | |

| Operating Income/(Loss) | $(6.79) | $(0.41) | $(6.38) |

| Net Income/(Loss) | $(3.14) | $(0.31) | $(2.83) |

| Net Income/(Loss) Per Share | $(0.07) | $(0.02) | $(0.05) |

| Non-GAAP Financial Measures | |||

| Adjusted EBITDA | $(6.80) | $(0.40) | $(6.40) |

| Adjusted Net Income/(Loss) – Excl Warrant Adjustment | $(6.79) | $(0.31) | $(6.48) |

| Cash and Cash Equivalents | $116.11 |

For a more detailed discussion of Advent’s second quarter 2021 results, please see the company’s financial statements and management’s discussion & analysis, which are available at ir.advent.energy.

The financial results include non-GAAP financial measures. These non-GAAP measures are more fully described and are reconciled from the respective measures determined under GAAP in “Presentation of Non-GAAP Financial Measures” and the attached appendix tables.

Q2 2021 Business Updates:

- Acquisition of the Fuel Cell Systems Businesses, Serenergy and fischer eco solutions GmbH, from fischer Group: On June 25, 2021, Advent announced that the Company entered into an agreement to acquire the fuel cell systems businesses, Serenergy and fischer eco solutions GmbH, from fischer Group. Serenergy, based in Denmark and the Philippines, is a leading manufacturer of HT-PEM fuel cell systems globally, with thousands shipped around the globe during its 15-year operation. fischer eco solutions (“FES”), based in Germany, provides fuel-cell stack assembly and testing as well as the production of critical fuel cell components, including membrane electrode assemblies (“MEAs”), bipolar plates, and reformers. FES operates a facility on fischer Group’s campus in Achern, Germany, and that facility will be leased to Advent upon closing of the deal. The transaction is expected to accelerate the implementation of Advent’s business plan and to expand Advent’s growing revenue base in full fuel cell stacks and systems. The transaction is expected to close in the third quarter of 2021.

- Expanding Global Footprint Through Acquisitions: With the addition of Serenergy and fischer eco solutions, Advent will expand its geographic footprint by three countries in Europe and southeast Asia and will add 92 employees to its growing team. The deal will bring together some of the leading minds in the high-temperature fuel cell space and will further build Advent’s platform to meet the rapidly increasing demand for clean energy worldwide. This transaction fully aligns with Advent’s “Any Fuel. Anywhere.” option and this, together with the previously completed UltraCell acquisition, makes Advent a true global leader in the remote and off-grid power market for fuel cell production, with mobility and aviation products on the horizon as well.

- Collaboration with the DOE: On March 1, 2021, Advent announced that it had entered into a joint development agreement (the “CRADA”) with the United States Department of Energy’s (DOE’s) Los Alamos National Laboratory (LANL), Brookhaven National Laboratory (BNL), and National Renewable Energy Laboratory (NREL). Under this CRADA, along with support from the DOE’s Hydrogen and Fuel Cell Technologies Office (HFTO), Advent’s team of scientists are working closely with its LANL, BNL, and NREL counterparts to develop breakthrough materials to help strengthen U.S. manufacturing in the fuel cell sector and bring high-temperature proton exchange membrane (HT-PEM) fuel cells to the market. This very important program has continued to progress over recent months, including delivery and testing of samples for key components of next generation HT-PEM materials.

- Announced Participation in Major European Hydrogen Project (IPCEI) “White Dragon” Proposal Submission: On May 19, 2021, Advent announced the national proposal for hydrogen technologies “White Dragon” was submitted by a group of the largest energy companies in Greece. The proposal sets forth a future vision for the entire hydrogen value chain and a path to expand its role in the Greek energy system’s reduced carbon goals. The objective of the project is to gradually replace the lignite power plants of Western Macedonia and transition to clean energy production and transmission, with the ultimate goal of fully decarbonizing Greece’s energy system. The “White Dragon” project plans to use large-scale renewable electricity to produce green hydrogen by electrolysis in Western Macedonia. This hydrogen would then be stored and, through Advent’s high-temperature fuel cells, supply all of Greece with clean electricity, green energy and heat. Further, in July 2021, Advent announced that it had been nominated by the Greek Ministry of Development and Investment to be part of the first wave of IPCEI on Hydrogen and had also been selected by the Ministry to be the Coordinator of Technology Field 2 dedicated to fuel cells and associated technologies. The company is pleased to be the designated fuel cell partner for an €8 billion project.

- Selection of Advent’s Wearable Fuel Cell for the New Contract with U.S. Department of Defense: On June 7, 2021, Advent signed a new contract through its subsidiary, UltraCell, with the U.S. Department of Defense for a wearable fuel cell. Through this contract, Advent will be focusing on completing the MIL-STD certification of UltraCell’s 50 W Reformed Methanol Wearable Fuel Cell Power System (“Honey Badger”). Honey Badger is designed to integrate with materials already utilized by the U.S. Army and will operate as a wearable battery that can be functioning “on the move.” As noted previously, Honey Badger was selected by the DoD’s National Defense Center for Energy and Environment (NDCEE) to take part in its 2021 demonstration/validation program. The Company remains excited about the continued progress of Honey Badger, and partnering with the U.S. Army is a landmark for Advent as its products become a key choice for defense applications.

- Announced New Chief Financial Officer: On July 2, 2021, Advent announced that Kevin Brackman joined the Company as its new Chief Financial Officer. He will report to Advent Chairman and CEO Dr. Vasilis Gregoriou. Mr. Brackman replaces Bill Hunter, who had served as CFO of Advent following its merger in February 2021 with AMCI Acquisition Corp., where he was Chief Executive Officer.

Dr. Gregoriou continued, “Our business momentum continues to build as we focus on developing and fostering new and existing customer relationships that support our strategic growth initiatives. Our sales of MEAs and redox flow battery components remain strong, and we expect to see both revenues and bookings increase as we move through the remainder of 2021. In addition, the pending acquisition of the fuel cell systems businesses, Serenergy and FES, from fischer Group will help us execute on our business plan.”

“The future for Advent Technologies has never been brighter. We are optimistic that Advent will continue to increase market share as the world focuses more on clean energy. Advent’s “Any Fuel. Anywhere.” products give us a clear advantage in a market for which very few companies compete and where hydrogen in its compressed gas form required by the low-temperature PEM competitors is not an economical option. Countries representing over half of global GHG emissions have communicated net-zero emissions targets. We believe our fuel cell technology will play a key role in driving decarbonization and as we move worldwide towards clean renewable energy, Advent is prepared to increasingly contribute to the goal of 100% clean energy.”

Conference Call

The Company will host a conference call on Thursday, August 12, 2021, at 9:00 AM ET to discuss its results.

To access the call please dial (833) 952-1516 from the United States, or (236) 714-2129 from outside the U.S. The conference call I.D. number is 1738845. Participants should dial in 5 to 10 minutes before the scheduled time.

A replay of the call can also be accessed via phone through August 26, 2021, by dialing (800) 585-8367 from the U.S., or (416) 621-4642 from outside the U.S. The conference I.D. number is 1738845.

About Advent Technologies Holdings, Inc.

Advent Technologies Holdings, Inc. is a US corporation that develops, manufactures, and assembles critical components for fuel cells and advanced energy systems in the renewable energy sector. Advent is headquartered in Boston, Massachusetts, with offices in the San Francisco Bay Area and Europe. With 120-plus patents issued (or pending) for its fuel cell technology, Advent holds the IP for next-generation high-temperature proton exchange membranes (HT-PEM) that enable various fuels to function at high temperatures under extreme conditions – offering a flexible “Any Fuel. Anywhere.” option for the automotive, maritime, aviation, and power generation sectors. For more information, visit www.Advent.energy.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the Company’s ability to realize the benefits from the business combination; the Company’s ability to maintain the listing of the Company’s common stock on Nasdaq; future financial performance; public securities’ potential liquidity and trading; impact from the outcome of any known and unknown litigation; ability to forecast and maintain an adequate rate of revenue growth and appropriately plan its expenses; expectations regarding future expenditures; future mix of revenue and effect on gross margins; attraction and retention of qualified directors, officers, employees and key personnel; ability to compete effectively in a competitive industry; ability to protect and enhance our corporate reputation and brand; expectations concerning our relationships and actions with our technology partners and other third parties; impact from future regulatory, judicial and legislative changes to the industry; ability to locate and acquire complementary technologies or services and integrate those into the Company’s business; future arrangements with, or investments in, other entities or associations; and intense competition and competitive pressure from other companies worldwide in the industries in which the Company will operate; and the risks identified under the heading “Risk Factors” in our Annual Report on Form 10-K/A filed with the Securities and Exchange Commission on May 20, 2021, as well as the other information we file with the SEC. We caution investors not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read our filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and we undertake no obligation to update or revise any of these statements. Our business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this press release, the Company has provided non-GAAP financial measures— Adjusted Net Income /(Loss) and Adjusted EBITDA —which present results on a basis adjusted for certain items. The Company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The Company believes that these non-GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the Company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the Company’s financial results in accordance with GAAP. The use of the terms Adjusted Net Income / (Loss) and Adjusted EBITDA may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These measures are reconciled from the respective measures under GAAP in the appendix below.

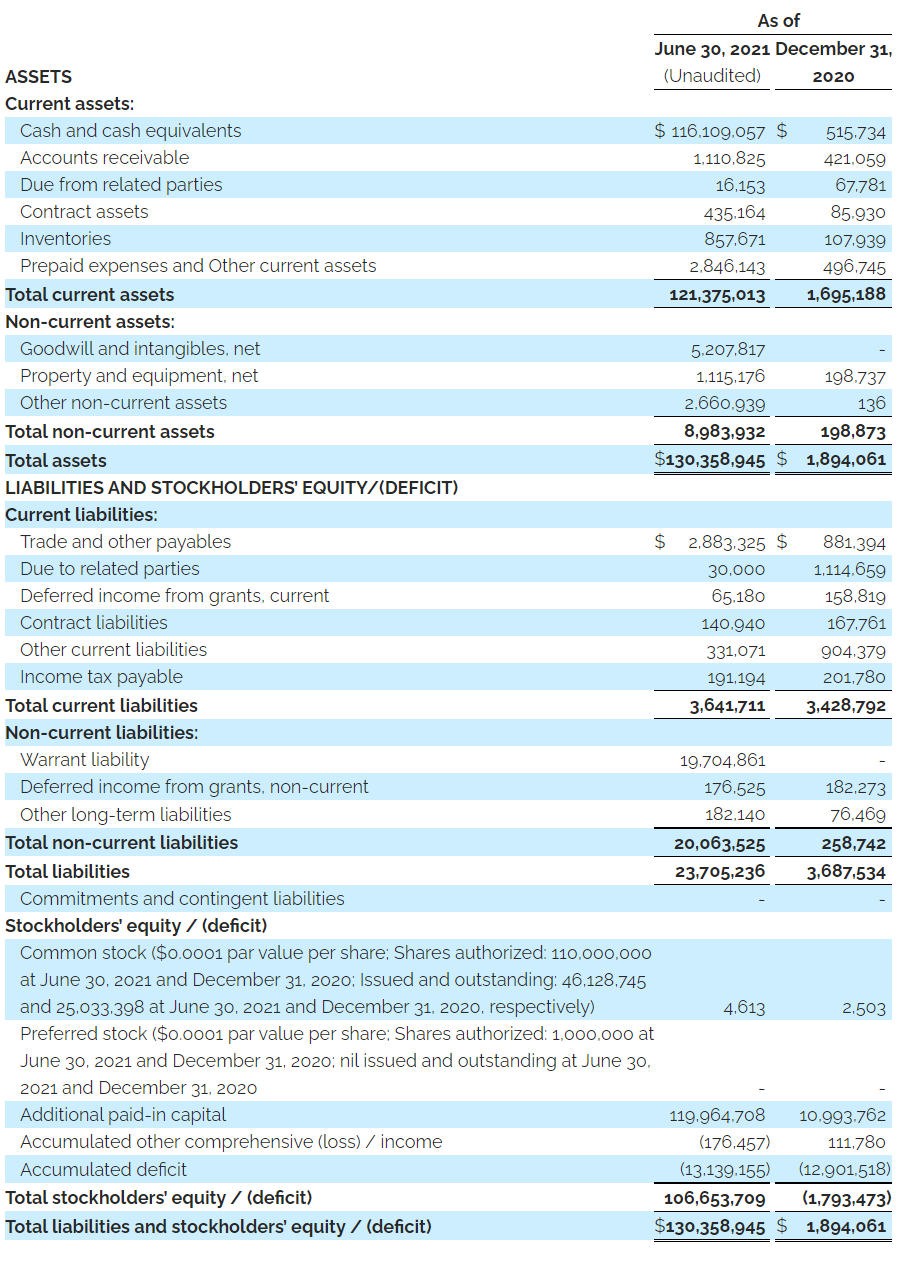

ADVENT TECHNOLOGIES HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

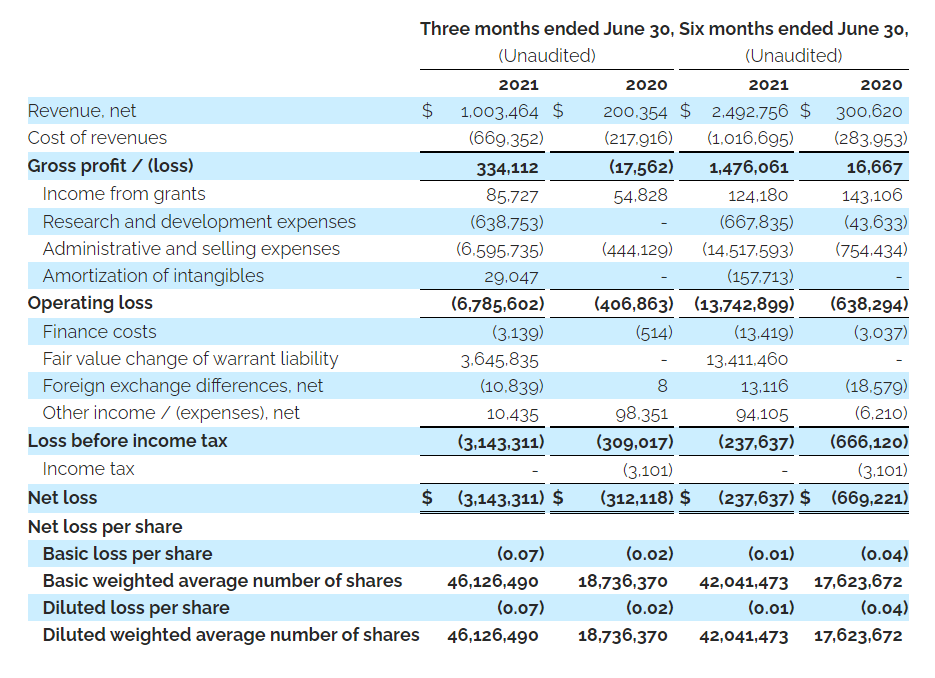

ADVENT TECHNOLOGIES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(All amounts in USD, except for number of shares)

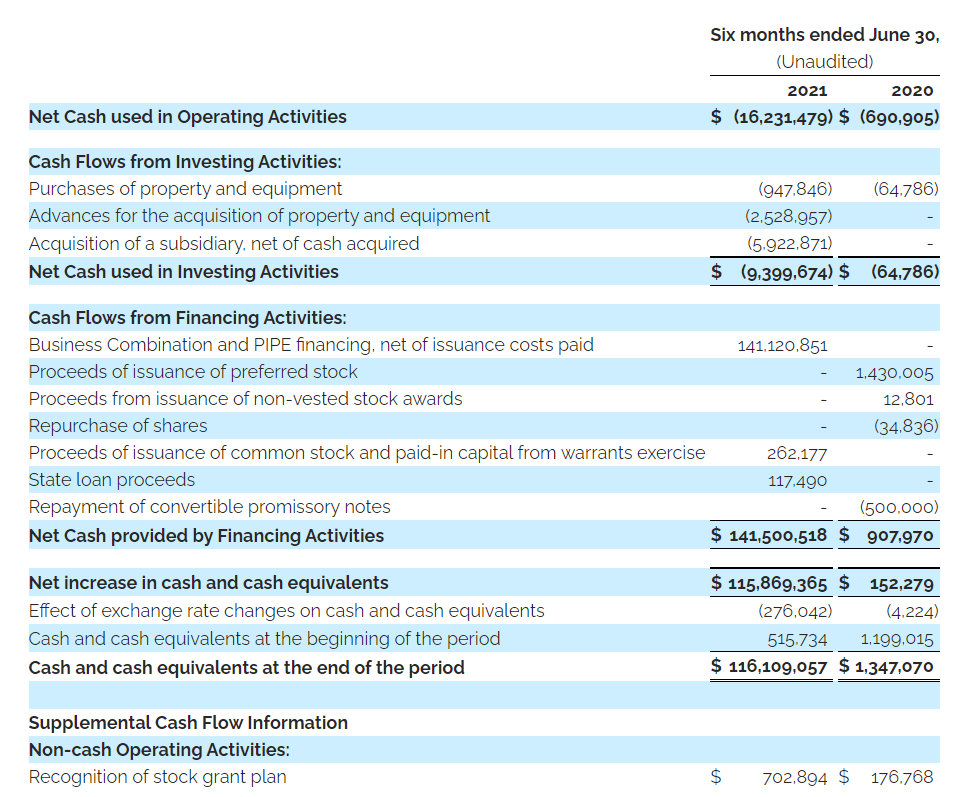

ADVENT TECHNOLOGIES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

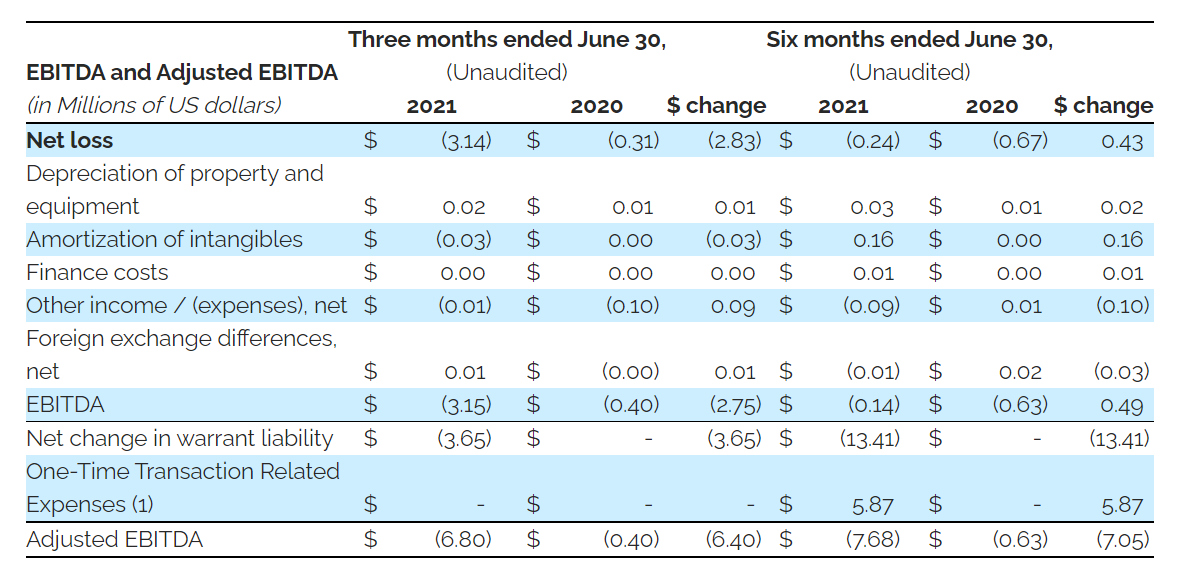

Supplemental Non-GAAP Measures and Reconciliations

In addition to providing measures prepared in accordance with GAAP, we present certain supplemental non-GAAP measures. These measures are EBITDA, Adjusted EBITDA and Adjusted Net Income / (Loss), which we use to evaluate our operating performance, for business planning purposes and to measure our performance relative to that of our peers. These non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore may differ from similar measures presented by other companies and may not be comparable to other similarly titled measures. We believe these measures are useful in evaluating the operating performance of the Company’s ongoing business. These measures should be considered in addition to, and not as a substitute for net income, operating expense and income, cash flows and other measures of financial performance and liquidity reported in accordance with GAAP. The calculation of these non-GAAP measures has been made on a consistent basis for all periods presented.

EBITDA and Adjusted EBITDA

These supplemental non-GAAP measures are provided to assist readers in determining our operating performance. We believe this measure is useful in assessing performance and highlighting trends on an overall basis. We also believe EBITDA and Adjusted EBITDA are frequently used by securities analysts and investors when comparing our results with those of other companies. EBITDA differs from the most comparable GAAP measure, net income / (loss), primarily because it does not include interest, income taxes, depreciation of property, plant and equipment, and amortization of intangible assets. Adjusted EBITDA adjusts EBITDA for transactional gains and losses, asset impairment charges, finance and other income and acquisition costs.

The following tables show a reconciliation of net income / (loss) to EBITDA and Adjusted EBITDA for the three and six months ended June 30, 2021 and 2020.

(1) Bonus awarded after consummation of the Business Combination effective February 4, 2021

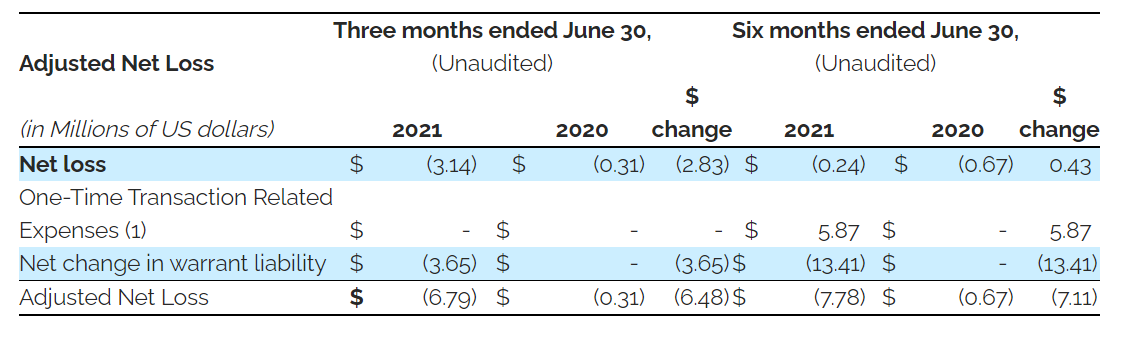

Adjusted Net Income/(Loss)

This supplemental non-GAAP measure is provided to assist readers in determining our financial performance. We believe this measure is useful in assessing our actual performance by adjusting our results from continuing operations for changes in warrant liability and one-time transaction costs. Adjusted Net Loss differs from the most comparable GAAP measure, net income / (loss), primarily because it does not include one-time transaction costs and warrant liability changes. The following table shows a reconciliation of net income/(loss) for the three and six months ended June 30, 2021 and 2020.

(1) Bonus awarded after consummation of the Business Combination effective February 4, 2021

Advent Technologies Holdings, Inc.

Elisabeth Maragoula

[email protected]

Sloane & Company

James Goldfarb / Emily Mohr

[email protected] / [email protected]